*************************************************** ***************************************************

FORECLOSURES

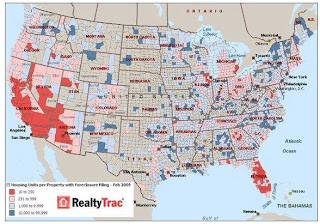

Nationwide, the number of households threatened with losing their homes in February rose 30 percent from 2008 levels, and 6 percent over January levels, according to RealtyTrac. In Florida, one out of every 188 homes is in some stage of foreclosure, with an increase of 13.79 percent since January and 42.97 percent since February 2008.

The Top 10 Foreclosure States as of February:

1. Nevada: 1 in 70 homes

2. Arizona: 1 in 147 homes

3. California: 1 in 165 homes

4. Florida: 1 in 188 homes

5. Idaho: 1 in 358 homes

6. Michigan: 1 in 360 homes

7. Illinois: 1 in 369 homes

8. Georgia: 1 in 389 homes

9. Oregon: 1 in 446 homes

10. Ohio: 1 in 451 homes

====================

Foreclosed Properties Overcome Their Bad Reputation

Fed by foreclosures, used home sales are actually climbing in some regions. But that’s taking business from new home builders, whose sales fell to a four-decade low in January–a 77% plunge from their peak in summer 2005.

===================

Mortgage 'Cramdown' Plan Hits Turbulence in Senate

The bill, which has already passed the House, would allow judges to write down mortgage debt for people in bankruptcy court. Democratic leaders have long sought such a "cramdown" provision for homeowners.

The bill needs 60 Senate votes to clear a procedural hurdle to passage, and Democratic aides say they are several votes shy. They had hoped the bill would reach a vote before the April recess but it has yet to be scheduled. Senate aides involved in the talks say that timing may slip further.

"The momentum has swung against cramdown," said Sen. Bob Corker (R., Tenn.).

The House bill is already substantially weaker than one crafted by senators several weeks ago. It limits cramdowns to existing mortgages; loans made in the future wouldn't qualify. Bankruptcy judges can write down a primary mortgage only if the borrower can show efforts to modify the loan were made prior to filing for bankruptcy.

Separately, the American Bankers Association on Friday raised alarms about a little-noticed part of the bill, saying it would let a borrower end up owning a house for a fraction of the purchase price if the lender breaches certain federal disclosure rules.

The industry said the House version of the bill would force judges to invalidate a lender's claim in bankruptcy for committing minor and accidental errors, such as understating a finance charge by as little as $36.

===================

Freddie Mac: 30-year mortgage rate falls to 5.03%

Freddie said Thursday the 30-year fixed-rate mortgage average fell from the previous week to 5.03% with an average 0.7 point for the week ending March 12. In the previous period, the average was 5.15%, and the year-ago average was 6.13%. New home sales fell 10.2% in January to the slowest pace since records began in January 1963 while pending existing home sales slowed by 7.7%, the weakest since the series began in January 2001.

More recently the Federal Reserve noted in its March 4th regional economic report that residential real estate markets remained in the doldrums in most areas, with only scattered, very tentative signs of stabilization.

===================

===================

Freddie/Fannie Results ower, & Freddie Puts Restrictions on Refinances

Home-mortgage company Freddie Mac reported a loss of $23.9 billion for the fourth quarter and said it will need a $30.8 billion injection of capital from the U.S. Treasury.

The company said it expects its provisions for losses on mortgage defaults to remain high this year and that it is likely to require further funds from the Treasury. Freddie had a loss of $2.45 billion in the year-earlier quarter.

For all of 2008, Freddie reported a loss of $50.1 billion, compared with a year-earlier loss of $3.1 billion. The losses over the past two years exceed the total of about $42 billion earned by the McLean, Va., company from 1971 through 2006. Freddie blamed the losses largely on rising mortgage defaults and declines in the value of derivatives used to hedge against interest-rate risks and other securities.

Fellow mortgager Fannie Mae last month reported a $25.2 billion loss for the fourth quarter.

The Treasury has agreed to provide as much as $200 billion of capital apiece to Fannie and Freddie in exchange for senior preferred stock. The Treasury already provided $13.8 billion to Freddie late last year, and Fannie has asked for $15.2 billion of capital under the same program.

Meanwhile, a new mortgage-refinancing program offered by Freddie as part of the Obama administration's foreclosure-prevention plan doesn't allow borrowers to shop around for the lowest fees. Any borrower with a Freddie-backed loan who wants to refinance under the program needs to do so through the company that services his current loan.

Fannie Mae, said borrowers with Fannie-backed loans will be able to seek refinancings under the program from more than 30,000 lenders nationwide. While Fannie is letting borrowers shop around, those deemed a higher risk are hit with fees that can total 3% or more of the loan balance. Freddie's maximum fee on these refinancings is 0.25%.

====================

Mortgage Investors Call for Changes in Rescue Plan

Investors who hold billions of dollars of residential mortgage-backed securities are pressing the Obama administration to make changes in its housing rescue plan.

Many of the four million borrowers the administration hopes to help through its loan-modification program have mortgages that were packaged into securities and sold to investors world-wide. Roughly $1.9 trillion of mortgage loans outstanding as of Dec. 31 had been packaged into securities that don't carry government backing, according to Inside Mortgage Finance. Thus far, servicers have been more reluctant to modify those loans than mortgages they own.

Home-equity loans and other second mortgages are an issue because such debt is junior to first mortgages. Some investors and analysts say that mortgage servicers may find it in their own financial interest to modify the first mortgage and not touch the related home-equity loan or line of credit.

Roughly half of delinquent subprime borrowers also have a second mortgage, according to Credit Suisse Group.

==================

Home-value insurance?

EquityLock Financial, a company based in Utah, offers contracts – as opposed to insurance policies – that agree to pay homeowners if they lose money when they sell later, an amount equal to the percentage of the downturn of their local market, based on an agreed-upon home-price index.

==================

Who knows the right price, Martha?

Homebuyers, home sellers, and real estate pros don't always agree on what a property is worth, and many buyers thinking that sellers and licensees set the price too high. According to a survey by HomeGain.com Inc., 63 percent of homeowners believe the price their practitioner recommended was too low. About 45 percent of sellers think prices should be 20- to 30-percent higher, and 14 percent believe their home should be priced 30 percent higher.

Meanwhile, 21 percent of homebuyers say homes are overpriced up to 10 percent; 32 percent say prices are 10 percent to 20 percent too high; and 6 percent say homes are overpriced by at least 20 percent. Only 18 percent of potential homebuyers believe properties are priced fairly.

No comments:

Post a Comment